Modular solutions with

intelligence & oomph!

Enterprise-grade, source code licensed products with stellar customer experiences

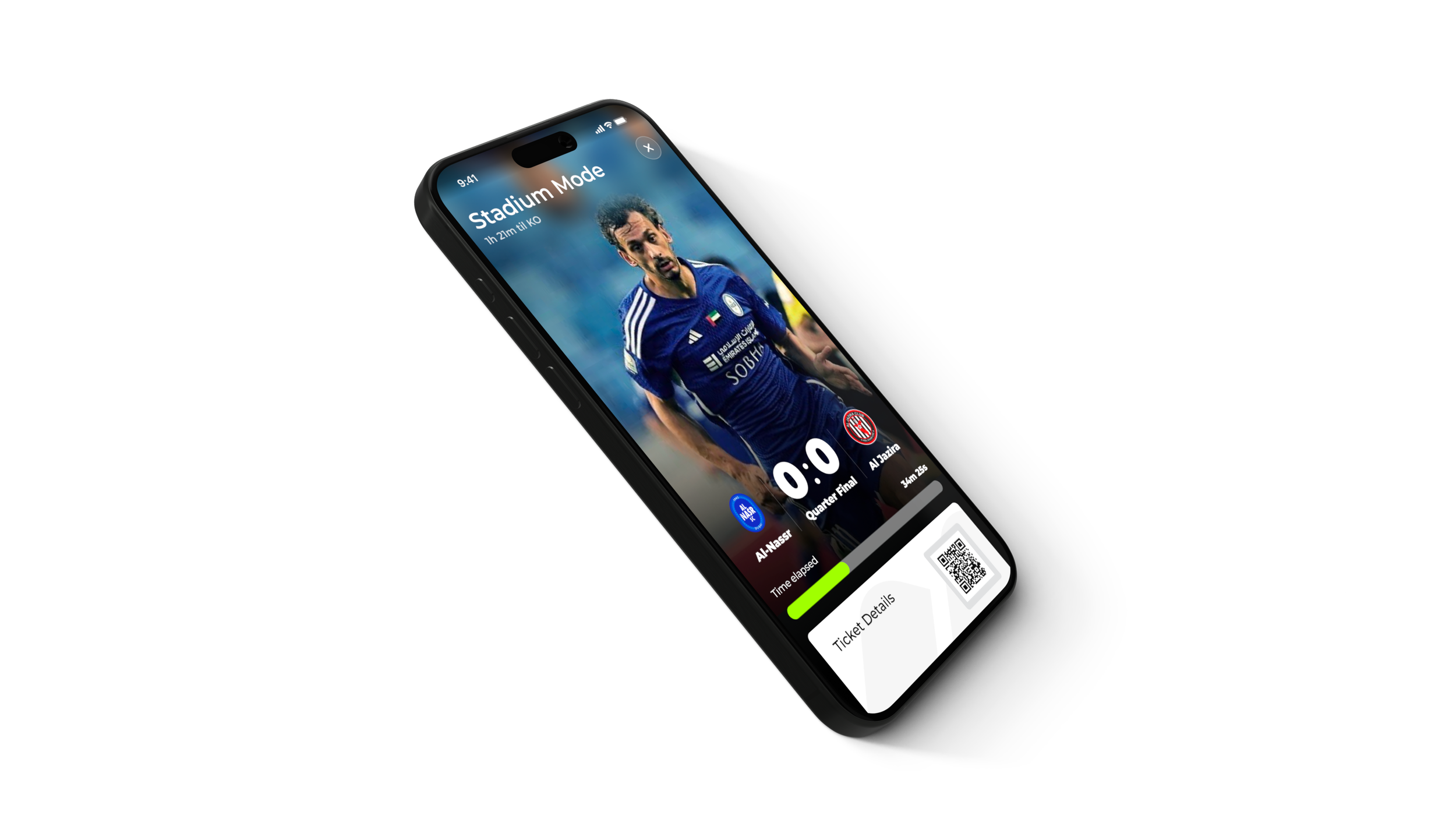

Kykoff helps GCC sports organisations create memorable fan experiences by simplifying complex operations. With its white-label, modular architecture and sleek interface, Kykoff empowers clubs, leagues, and stadiums to easily configure a tailored solution for enhanced fan engagement and streamlined operations.

The current complexity in SME and corporate banking platforms reflects the trade-off between offering comprehensive features and maintaining simplicity. While the breadth of services is essential, addressing usability, integration, flexibility and early commercialization is critical for improving efficiency and meeting the evolving expectations of businesses. Chekkyr simplifies complex financial workflows such as Onboarding, Transactional banking, Service Requests (and more), and drives seamless digital transformation

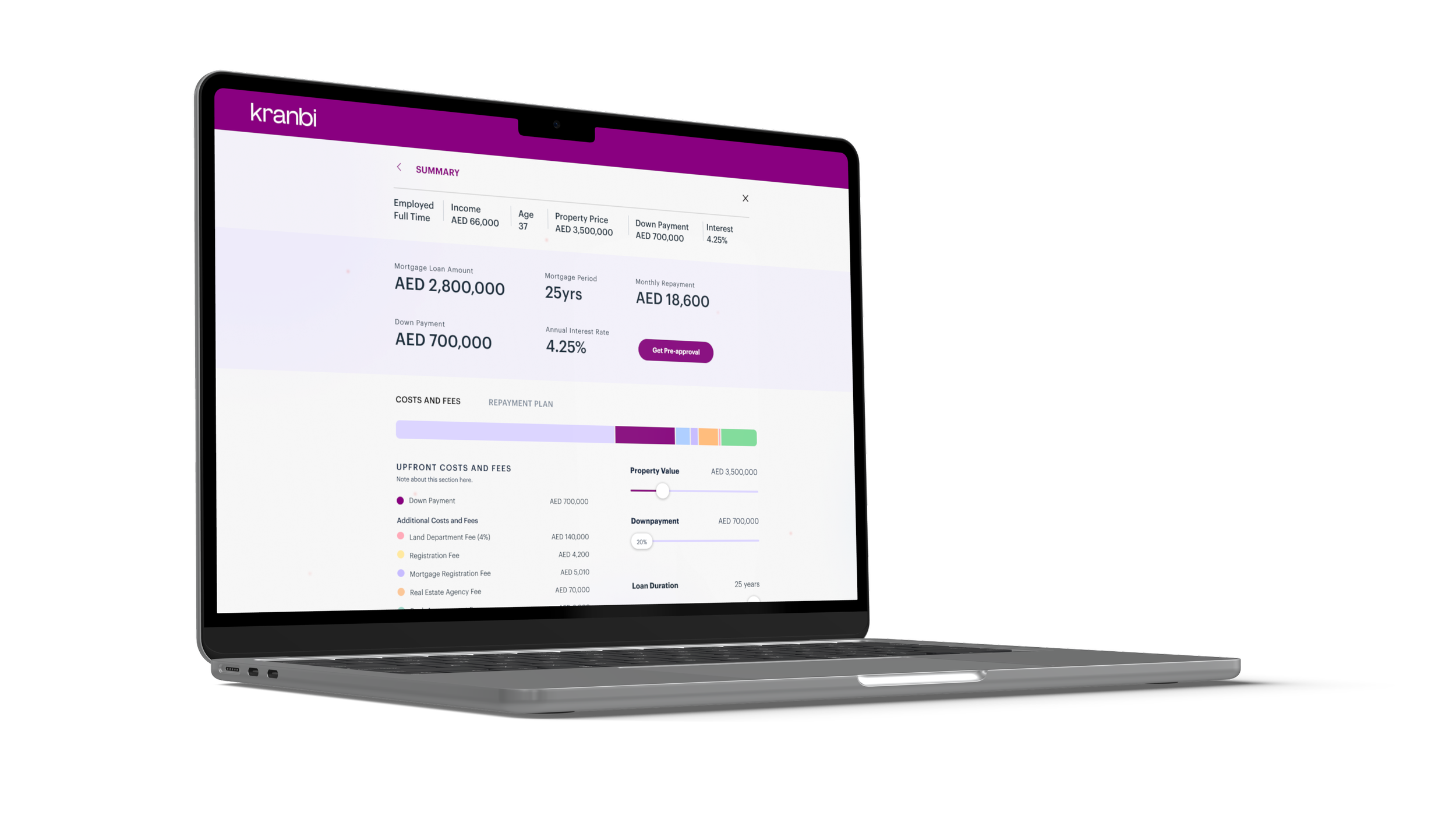

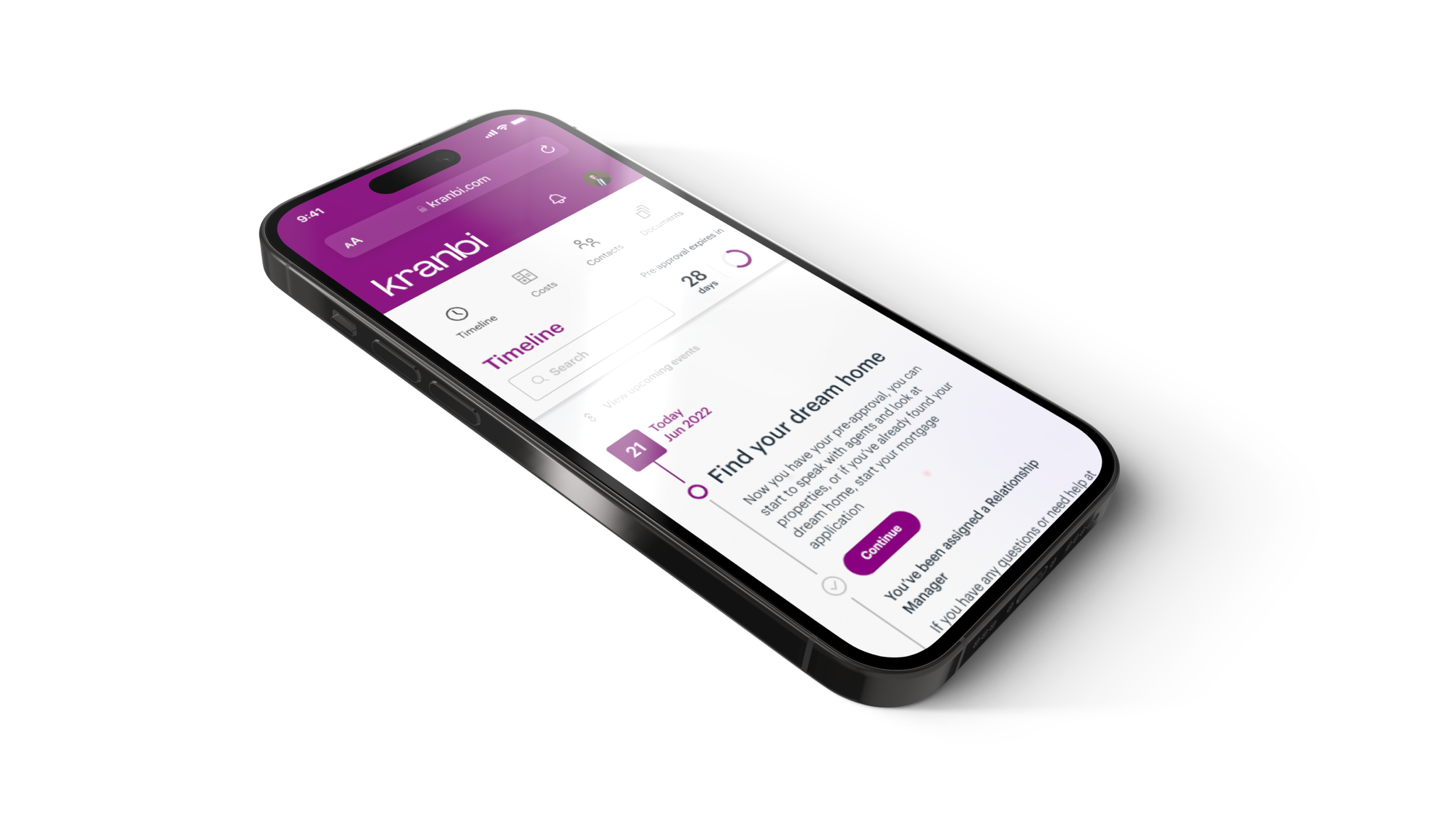

Recognising the need for a more accessible and efficient mortgage experience Kranbi is an end-to-end digital platform. This comprehensive solution empowers financial institutions to expand their reach beyond traditional banking by offering a streamlined and intuitive digital experience for mortgages and home improvement loans. By optimising the full mortgage process this platform is designed to increase revenue through high-value leads, reduce operational costs, and significantly improve the customer experience.

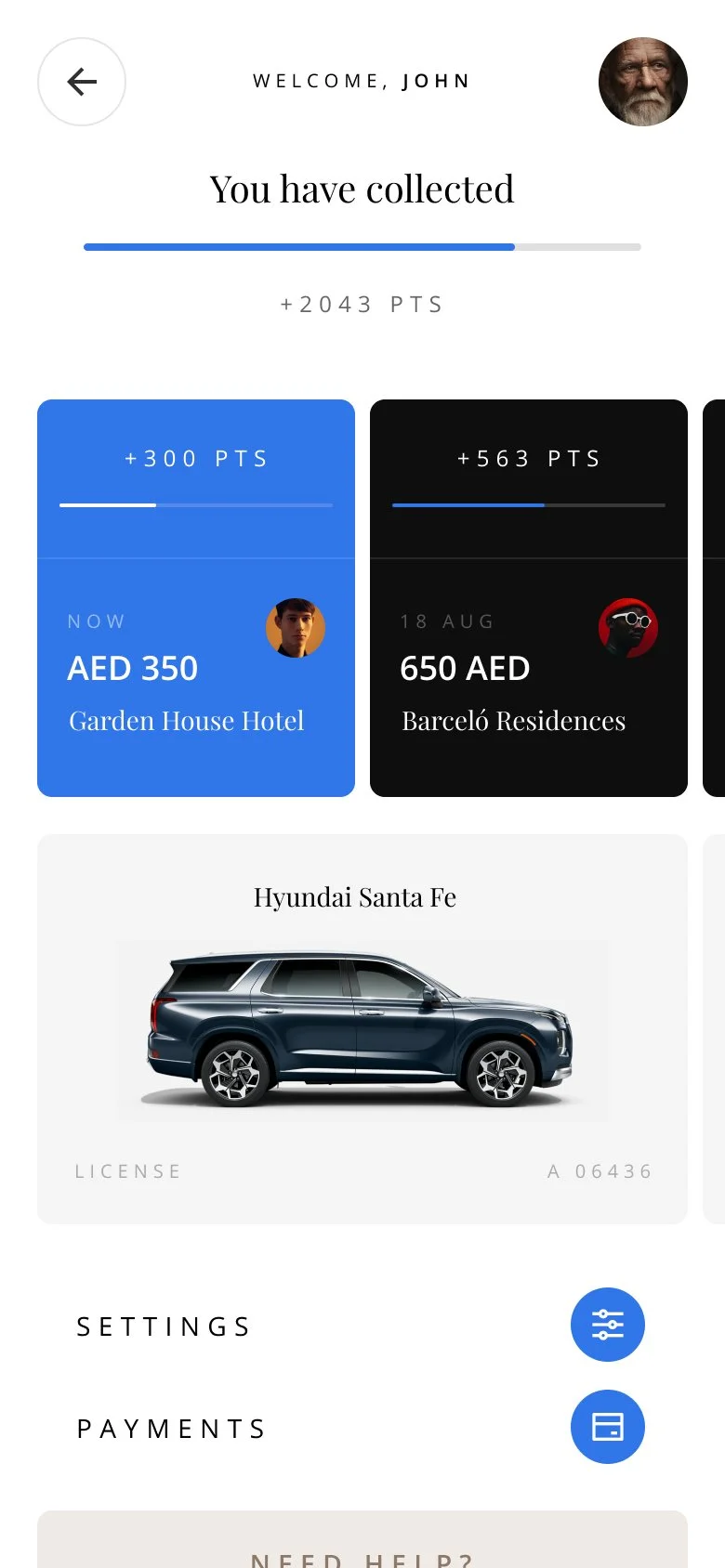

firefly

Data-driven, AI powered platform tracking customer behaviors, preferences, spending and more within physical spaces

What you get with our Enterprise grade source code licenses

-

Select an infrastructure location of your preference, granting the flexibility to host either on-premises to adhere to local regulatory requirements or through various cloud providers, such as AWS, Azure, Oracle, GCP, Huawei, or IBM Cloud.

-

Retain the flexibility to customise and scale your solution while taking advantage of our ongoing updates, patches, and enhancements.

-

Adapt the platform to meet your specific business requirements without restrictions or dependence on the vendor. Adjust existing features, introduce new functionalities, and evolve your solution in response to changing market demands.

-

Bring your product to market significantly faster than building from scratch. Leverage our pre-built core features as a foundation, with the flexibility to fully customise them to align with your unique requirements.

-

Reduce development costs and resource expenditure by avoiding the need to build from scratch. Utilise our robust foundation and concentrate on customisations and delivering unique value propositions.

-

Our dedicated support team is available to address any bugs or issues and deliver tailored solutions suited to your specific environment.

Expert-led training, conducted by professionals with over a decade of experience, empowers your team to independently customise the platform to meet your needs. -

Access a ready-made solution with our source code, designed to deliver exceptional security, compliance, and scalability. Additionally, enjoy complete control to customise and adapt the platform as your business evolves or regulatory requirements shift.

-

Utilise our built-in integrations and modular framework to effortlessly connect with third-party solutions and software, including payment gateways, AML/KYC/KYB systems, and other providers tailored to your needs.

Minimise development costs and resource allocation by eliminating the need to start from scratch. Leverage our solid foundation, focusing your efforts on customisations and creating distinctive value propositions.

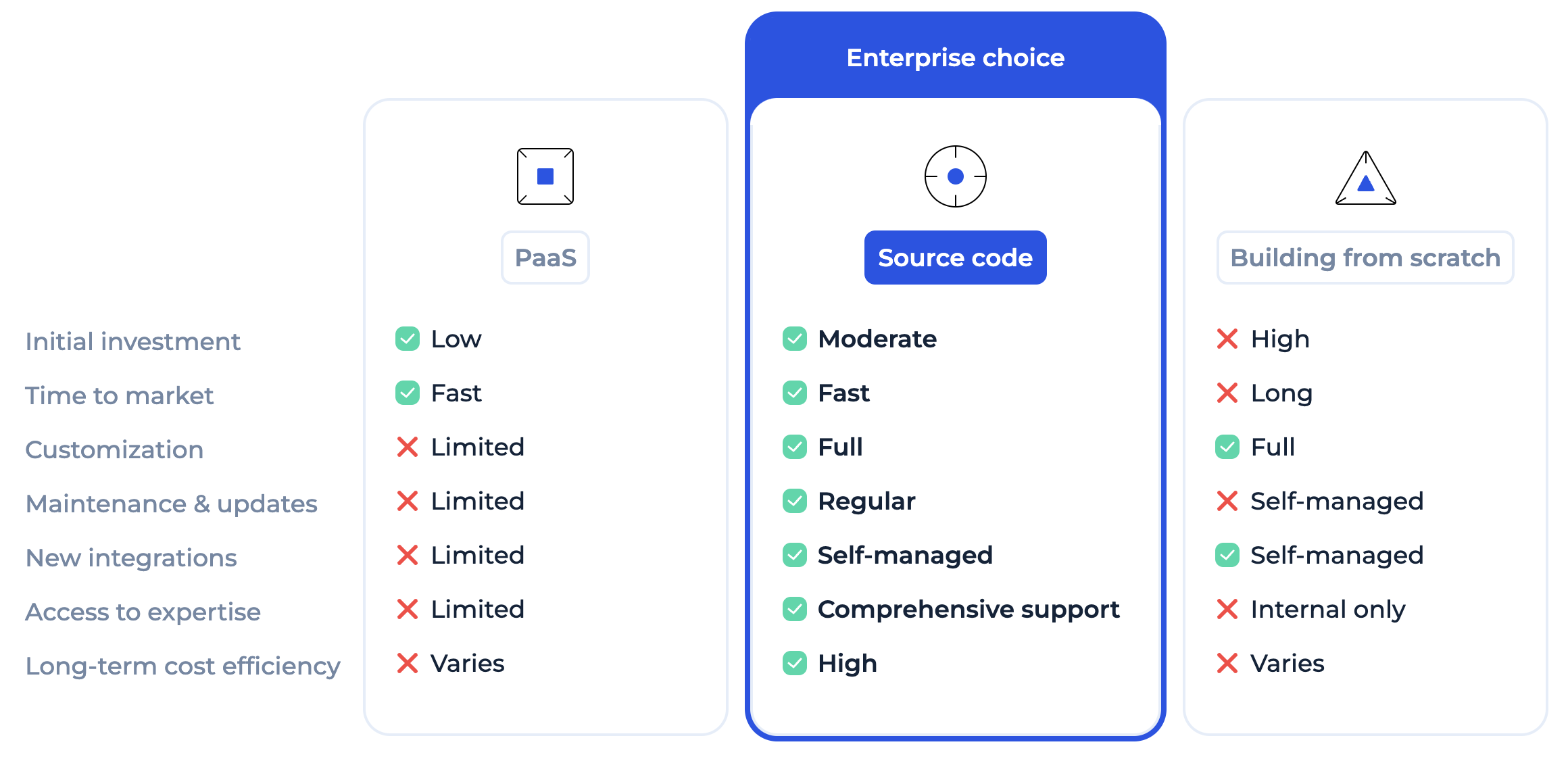

Why Enterprises choose our solutions

Contact Us

Interested in working together? Fill out some info and we will be in touch shortly. We can’t wait to hear from you!