Banking with Purpose

Modular fintech solution for the creation and fast launch of financial onboarding and digital banking products for web or mobile

Simplifying workflows, to create efficient experiences

The current complexity in SME and corporate banking platforms reflects the trade-off between offering comprehensive features and maintaining simplicity. While the breadth of services is essential, addressing usability, integration, flexibility and early commercialization is critical for improving efficiency and meeting the evolving expectations of businesses. Chekkyr simplifies complex financial workflows such as Onboarding, Transactional banking, Service Requests and more.

Fragmented approach and lacking seamless integrations

Lack of consistent paradigms and poor permissioning lead to Maker and Checker information overload and inconsistencies. Impact: Causes data silos, excessive manual reconciliation and high drop-off rates

Complex Information hierarchy structures & poor end-user experience

Poor Navigation and an over-stitching of information in an unstructured manner. Impact: Results in overwhelmed users, higher customer support demands and an increase in costs

Lack of consistenct and system scalability, with poor governance

Lacking a centralized Governance system which is permissioned and automated. Impact: Results in slower updates, limited flexibility, and higher maintenance costs

Ineffective and untimely commercialization of the client relationship

A shortfall in parallel processing of tasks whereby a serial approach is time consuming Impact: Causes a loss of potential revenues and a mismatch with a customer’s key needs

What you get with our Enterprise grade source code licensed fan engagement platform:

Designed as a white label solution, with a modular configuration-based architecture, and a sleek, intuitive interface it equips clubs, leagues and stadiums with the tools to enhance fan self-directed engagement, streamline operations and efficiently commercialize the relationship.

-

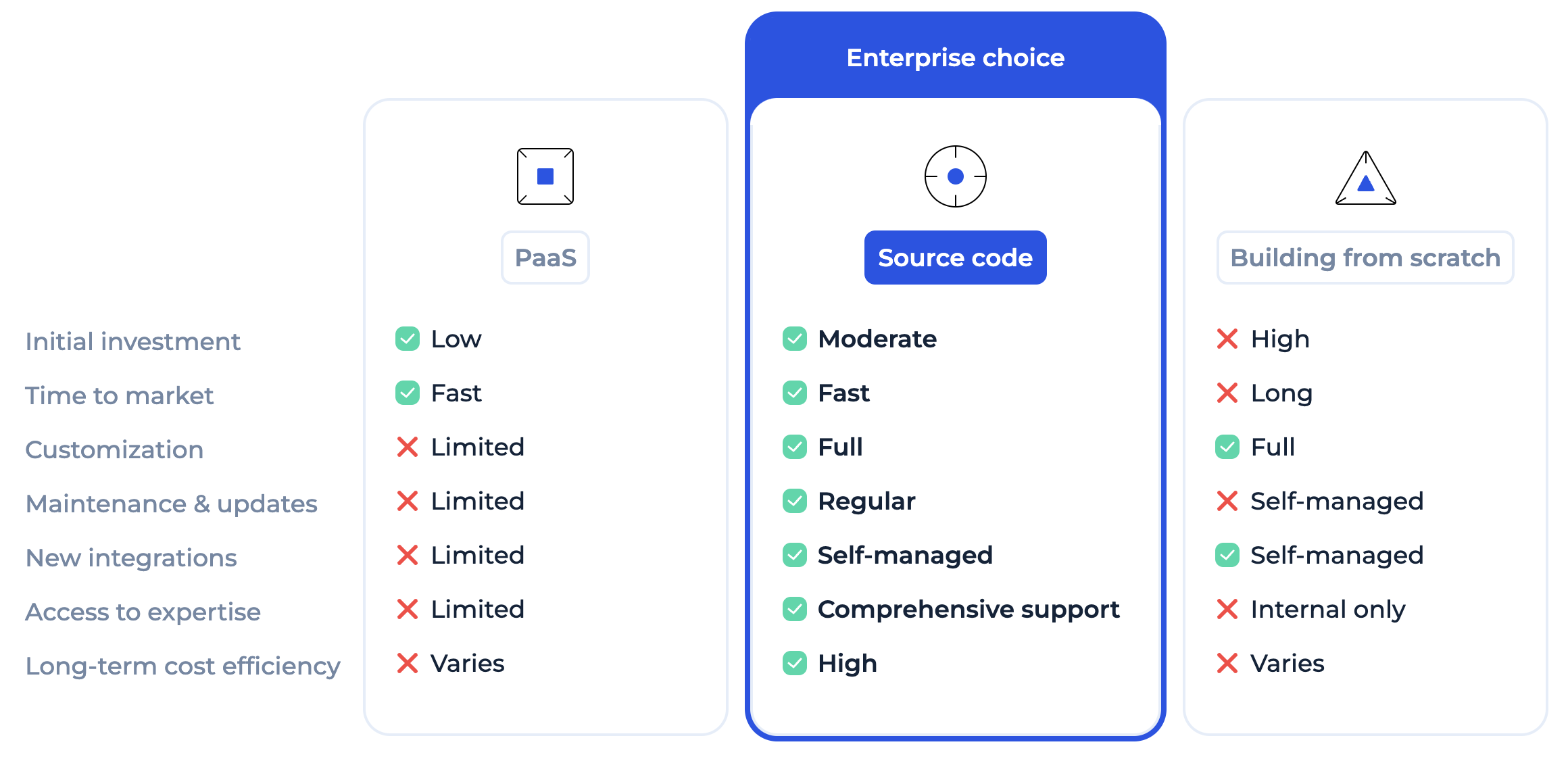

Select an infrastructure location of your preference, granting the flexibility to host either on-premises to adhere to local regulatory requirements or through various cloud providers, such as AWS, Azure, Oracle, GCP, Huawei, or IBM Cloud.

-

Retain the flexibility to customise and scale your solution while taking advantage of our ongoing updates, patches, and enhancements.

-

Adapt the platform to meet your specific business requirements without restrictions or dependence on the vendor. Adjust existing features, introduce new functionalities, and evolve your solution in response to changing market demands.

-

Bring your product to market significantly faster than building from scratch. Leverage our pre-built core features as a foundation, with the flexibility to fully customise them to align with your unique requirements.

-

Reduce development costs and resource expenditure by avoiding the need to build from scratch. Utilise our robust foundation and concentrate on customisations and delivering unique value propositions.

-

Our dedicated support team is available to address any bugs or issues and deliver tailored solutions suited to your specific environment.

Expert-led training, conducted by professionals with over a decade of experience, empowers your team to independently customise the platform to meet your needs. -

Access a ready-made solution with our source code, designed to deliver exceptional security, compliance, and scalability. Additionally, enjoy complete control to customise and adapt the platform as your business evolves or regulatory requirements shift.

-

Utilise our built-in integrations and modular framework to effortlessly connect with third-party solutions and software, including payment gateways, AML/KYC/KYB systems, and other providers tailored to your needs.

Minimise development costs and resource allocation by eliminating the need to start from scratch. Leverage our solid foundation, focusing your efforts on customisations and creating distinctive value propositions.

Why Enterprises choose our solutions

Key Features and functionality offered by Chekkyr

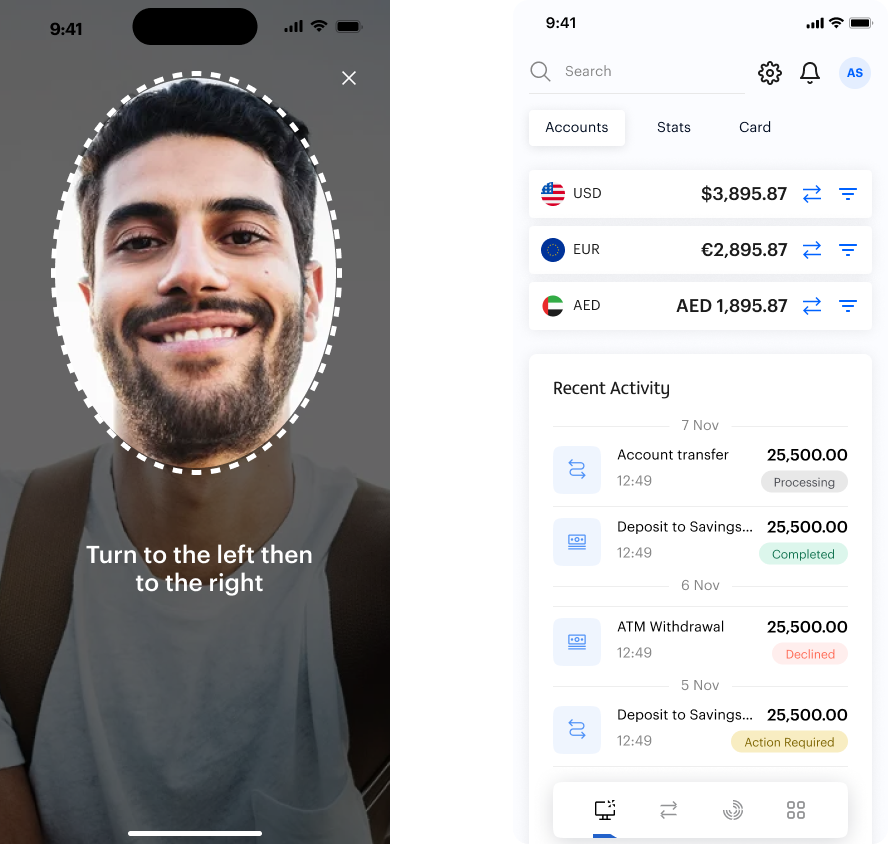

ONBOARDING

Transform onboarding with digital KYC/AML, biometric verification, and seamless customer journeys. Our intuitive tools ensure fast, compliant account setup, reducing friction for both customers and staff.

ACCOUNT MANAGEMENT

Effortlessly manage savings, checking, and multi-currency accounts with real-time updates. Our banking-in-a-box solution ensures seamless account creation, balance tracking, and integrated transaction history for an unparalleled customer experience.

PAYMENTS & TRANSFERS

Enable fast, secure domestic and international transfers with built-in compliance. Our solution supports P2P payments, recurring transfers, and multi-channel payment processing to simplify money movement for your customers.

CARD & LOAN MANAGEMENT

Launch and manage physical, virtual, debit, and credit cards with full customer control. Features include instant issuance, spending limits, card freezing, and seamless integrations for a modern, user-centric card experience.

SERVICE REQUESTS

Empower customers with robo-advisors, portfolio analytics, and investment insights. From goal-based planning to automated tracking, our platform brings modern wealth management to your banking services.

REWARDS & LOYALTY

Effortlessly manage savings, checking, and multi-currency accounts with real-time updates. Our banking-in-a-box solution ensures seamless account creation, balance tracking, and integrated transaction history for an unparalleled customer experience.

Who we have worked with

Contact Us

Interested in working together? Fill out some info and we will be in touch shortly. We can’t wait to hear from you!